Everything about Estate Planning Attorney

Everything about Estate Planning Attorney

Blog Article

The Best Guide To Estate Planning Attorney

Table of Contents3 Easy Facts About Estate Planning Attorney DescribedLittle Known Facts About Estate Planning Attorney.Estate Planning Attorney - An OverviewThe Only Guide for Estate Planning Attorney

Estate planning is concerning making sure your family comprehends just how you want your possessions and events to be handled in the event of your death or incapacitation. That's where estate planning attorneys come in.

It's vital to function with an attorney or legislation company experienced in estate legislation, state and government tax obligation planning, and trust fund management. Or else, your estate plan might have voids or oversights.

Having conversations with the individuals you like about your own passing can really feel awkward. The structure of your estate strategy begins by assuming with these hard scenarios.

The 9-Minute Rule for Estate Planning Attorney

Whether you're simply beginning the estate planning process or desire to change an existing strategy, an estate planning attorney can be an indispensable source. Estate Planning Attorney. You might consider asking friends and colleagues for referrals. However, you can additionally ask your employer if they supply lawful strategy benefits, which can help link you with a network of seasoned attorneys for your lawful needs, consisting of estate planning.

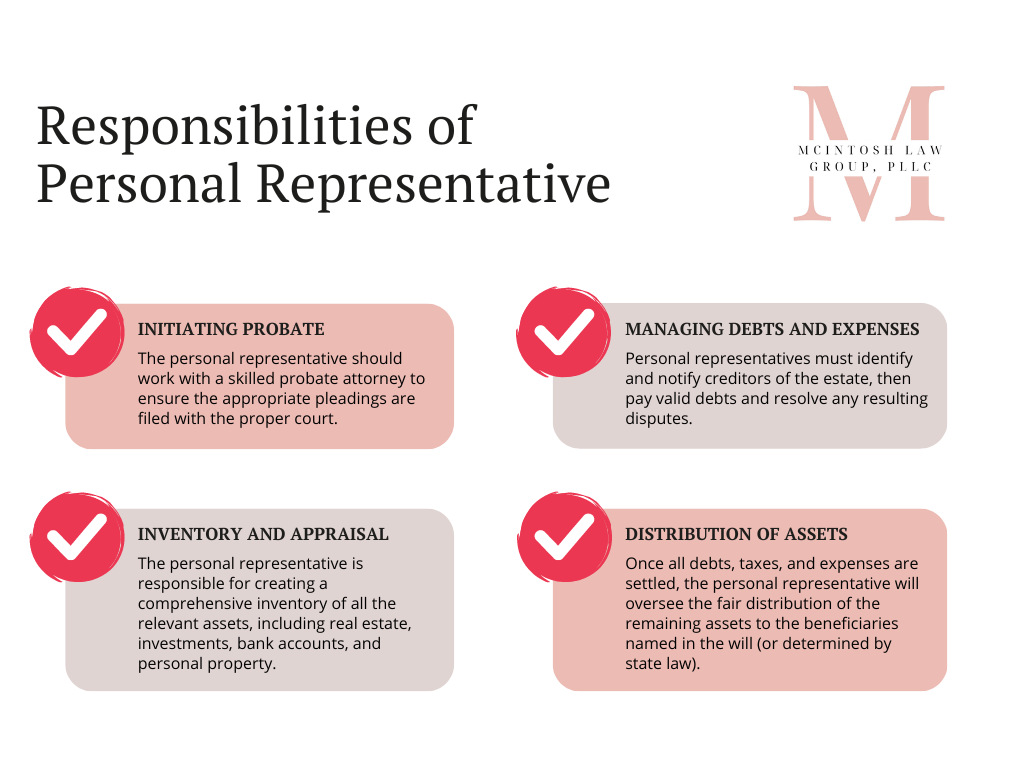

Estate intending lawyers are useful during the estate planning procedure and afterwards with the procedure of probate court. They recognize the state and government regulations that will certainly influence try this your estate.

Little Known Questions About Estate Planning Attorney.

A good estate planning attorney may be able to assist you avoid probate court completely, yet that largely depends on the kind of assets in the deceased's estate and just how they are lawfully enabled to be transferred. On the occasion that a recipient (and even a specific not marked as a beneficiary) introduces that she or he intends to contest the will and sue the estate of a departed relative or loved one that you likewise stand to take advantage of, it could be in your benefit to get in touch with an estate preparation attorney right away.

Regular attorney really feels usually vary from $250 - $350/hour, according to NOLO.1 The more complicated your estate, the much more it will set you back to set up., visit the Safety Understanding.

The smart Trick of Estate Planning Attorney That Nobody is Discussing

They will certainly encourage you on the finest lawful choices and records to shield your possessions. A living trust fund is this article a lawful file that can resolve your desires while you're still active. If you have a living count on, you can bequeath your properties to your enjoyed ones throughout your lifetime; they just don't obtain access to it up until you pass.

You might have a Living Trust fund composed during your life time that provides $100,000 to your child, yet only if she graduates from university. There are some documents that enter into impact after your death (EX-SPOUSE: Last Will and Testament), and others that you can use for clever asset administration while you are still to life (EX-SPOUSE: health care instructions).

As opposed to leaving your relative to presume (or suggest), you should make your objectives clear now by working with an estate preparation attorney. Your lawyer will certainly help you draft medical care regulations and powers of attorney that fit your lifestyle, assets, and future objectives. The most typical means of avoiding probate and estate tax obligations is with making use of Trust funds.

If you carefully intend your estate now, you might be able to stop your heirs find out here now from being pushed into lengthy lawful battles, the court system, and adversarial family disputes. You desire your beneficiaries to have an easy time with preparation and lawful concerns after your death. A correctly implemented set of estate plans will conserve your household time, cash, and a large amount of tension.

Report this page